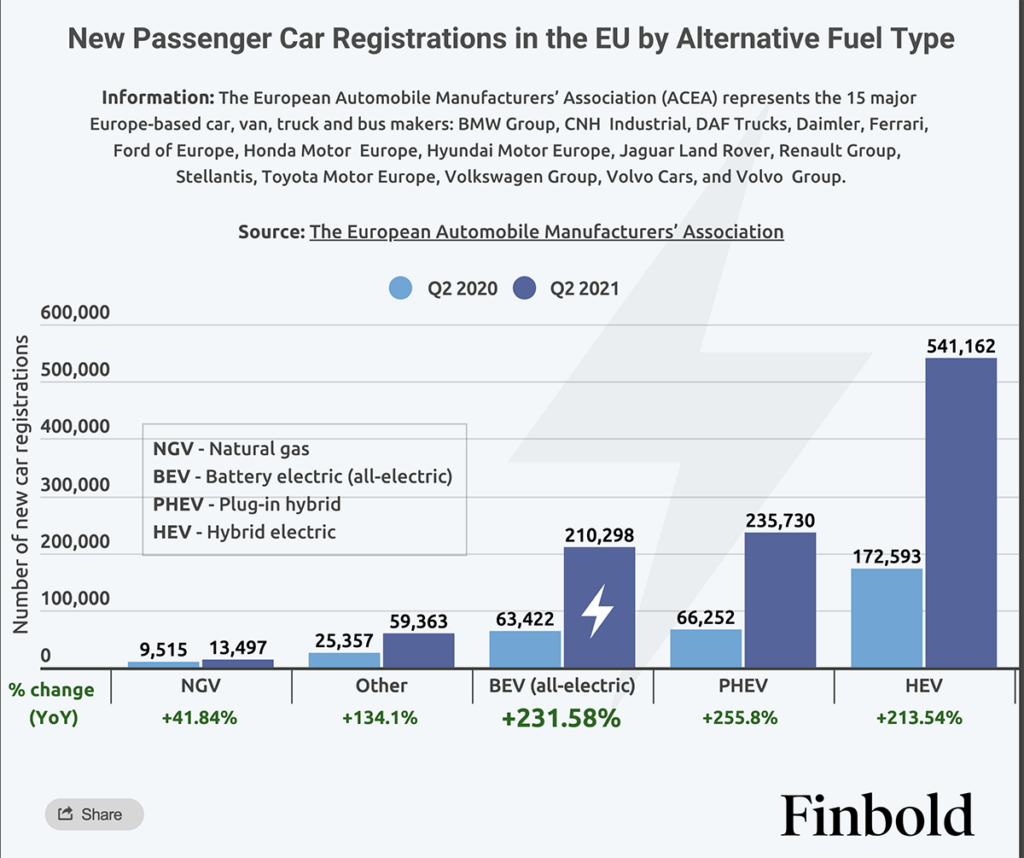

According to data acquired by Finbold, the demand for new passenger battery electric (all-electric) vehicles across Europe surged 231.58% between Q2 2020 and Q2 2021, from 63,422 to 210,298. The figures reflect a triple growth in demand for all-electric vehicles.

The hybrid electric vehicle demand also spiked by 213.54% to 541,162, representing the most significant growth for all new passenger vehicles in Europe. In total, the electric vehicle registration as of Q2 2021 stands at 751,460, a growth of at least three times from the Q2 2020 cumulative figure of 236,015. The data on new passenger car registration in the EU is provided by the European Automobile Manufacturers’ Association (ACEA).

Strong growth

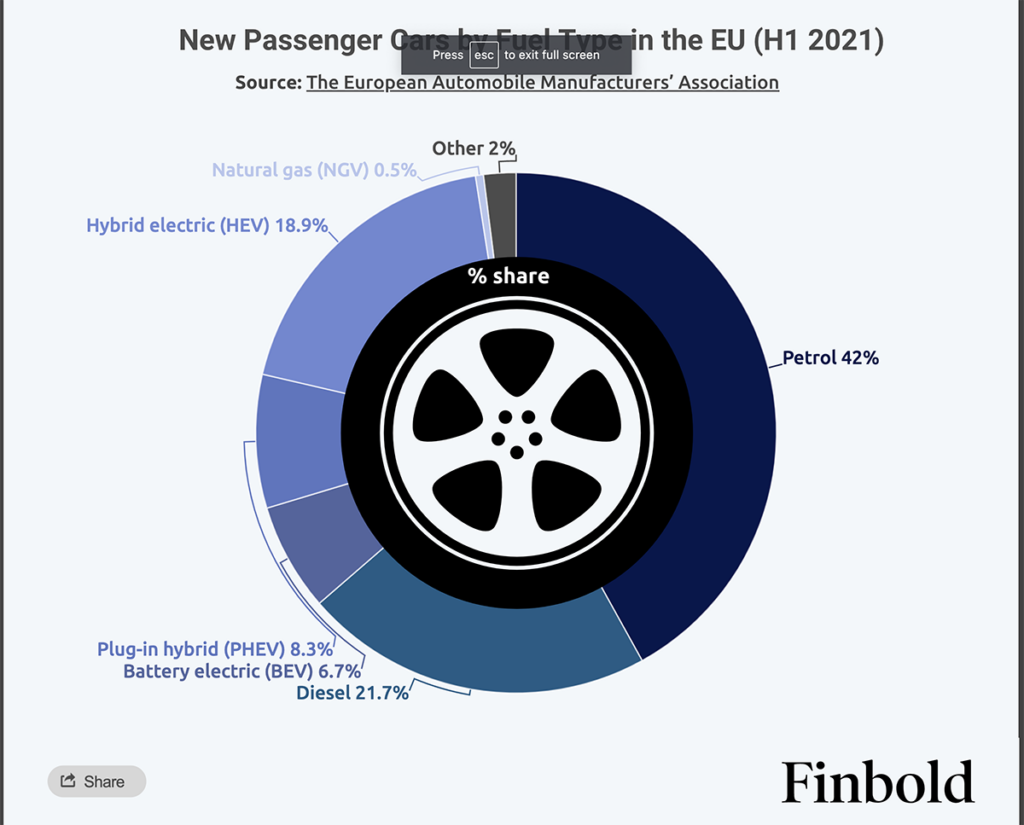

Furthermore, during the first half of 2021, battery electric vehicles recorded a share of 6.7% under new passenger cars by fuel type in the region. Hybrid electric cars had a share of 18.9%, while plug-in hybrids stood at 8.3%. Petrol accounted for the highest percentage at 42%, followed by diesel at 21.7%.

The increase in demand for electric vehicles across Europe is motivated by the European Commission’s goal to achieve a climate-neutral economy by 2050. There are stringent restrictions on automotive emissions driving the expansion of the market. In this line, car manufacturers are making commitments to climate change while at the same time accelerating their investments in electrification and meeting policy requirements.

Notably, across Europe, traditional manufacturers like BMW, Audi, and Volvo are also increasingly venturing into the electric vehicle scene. Simultaneously, the emergence of new players is offering consumers a wide range of products leading to the growth in demand for electric vehicles in the region.

Friendly incentives

With the commitment towards climate-friendly initiatives, most governments across the region have utilised the opportunity by establishing friendly incentives. The incentive is both targeting consumers and manufacturers in the space.

For instance, when the coronavirus pandemic hit, most governments across the region focused their stimulus packages on companies that are operating in line with fighting climate change. Notably, a big part of the support focused on incentives for consumers to buy EVs, creating a surge in demand.

Shortage

Although the demand for electric vehicles surged, it emerged during a global chip shortage that also impacted the industry. The deficit was mainly a result of supply chain constraints that occurred during the pandemic. However, the severity of the scarcity will play out later this year.

The future of the EU electric vehicle industry

Worth mentioning is that electric vehicles are considerably expensive and not affordable to the masses without subsidies. Therefore, the numbers will keep soaring if the industry records increased competition and the scaling up of production. This situation explains why petrol passenger cars demand remained high in 2021.

Government subsidies

Although the EU electric vehicle momentum heavily relied on government support, the move spells doom for prospects in the industry. Over the past 12 months, the gains made could easily be reversed when most government subsidies are limited or expire.

Furthermore, the European market is not immune to other challenges facing the industry. The sector is still faced with high manufacturing costs. To tackle these challenges, manufacturers rely on technological advancements and proactive government initiatives to supplement growth.